Urban Asset Twin

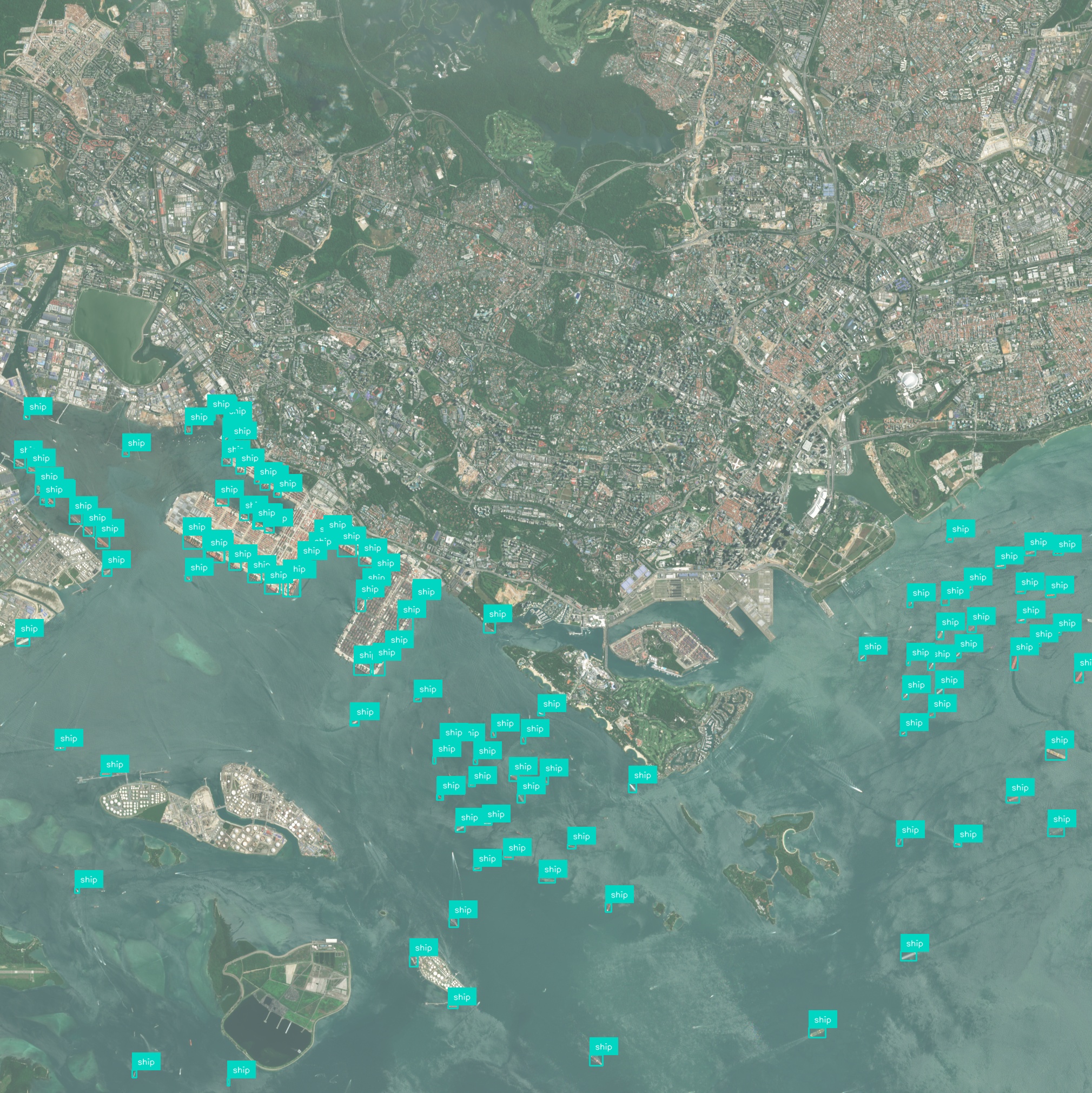

High-resolution urban digital twins integrate geospatial, structural, and environmental data to streamline property-level risk assessment and underwriting decisions.

High-resolution urban digital twins integrate geospatial, structural, and environmental data to streamline property-level risk assessment and underwriting decisions.

How does it work?

Traditional property underwriting relies on static reports and manual inspections, leading to slow processes and incomplete risk profiles. Urban digital twins aggregate real-time geospatial and structural data at the asset level, enabling precise risk quantification and faster decision-making.

The digital twin integrates 3D structural models with historical loss and environmental data to deliver precise risk scores at the building level. This granular insight reduces unexpected claims by identifying hidden vulnerabilities.

By leveraging remote sensing and sensor feeds, underwriters can assess property condition without field visits. This reduces travel expenses and manual labor while maintaining data quality.

Automated data ingestion and analysis shortens the underwriting cycle from weeks to hours. Faster decision-making improves operational efficiency and customer satisfaction.

Machine learning algorithms simulate various hazard scenarios using the digital twin’s detailed asset models. Insurers can forecast potential losses and adjust pricing proactively.

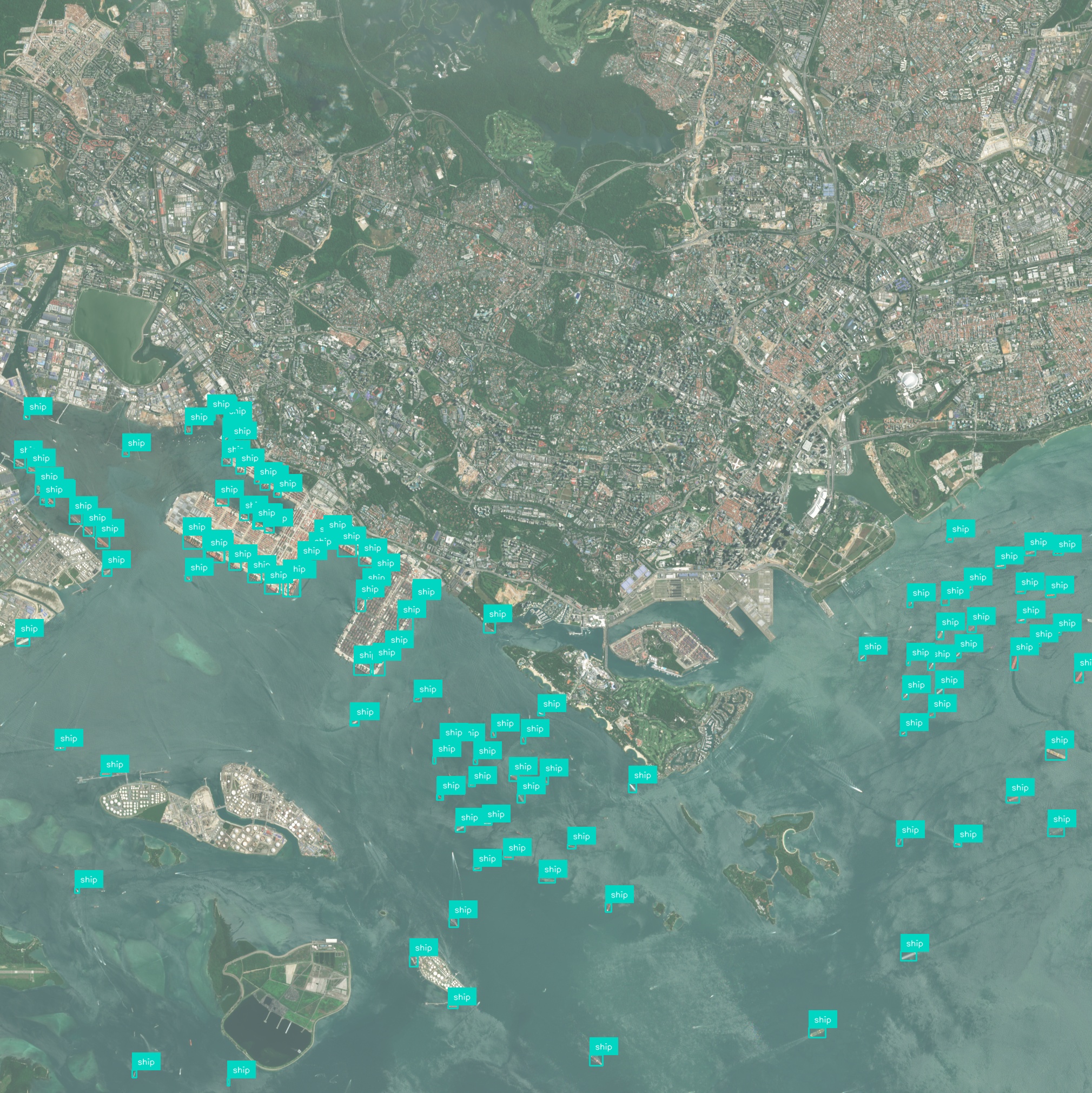

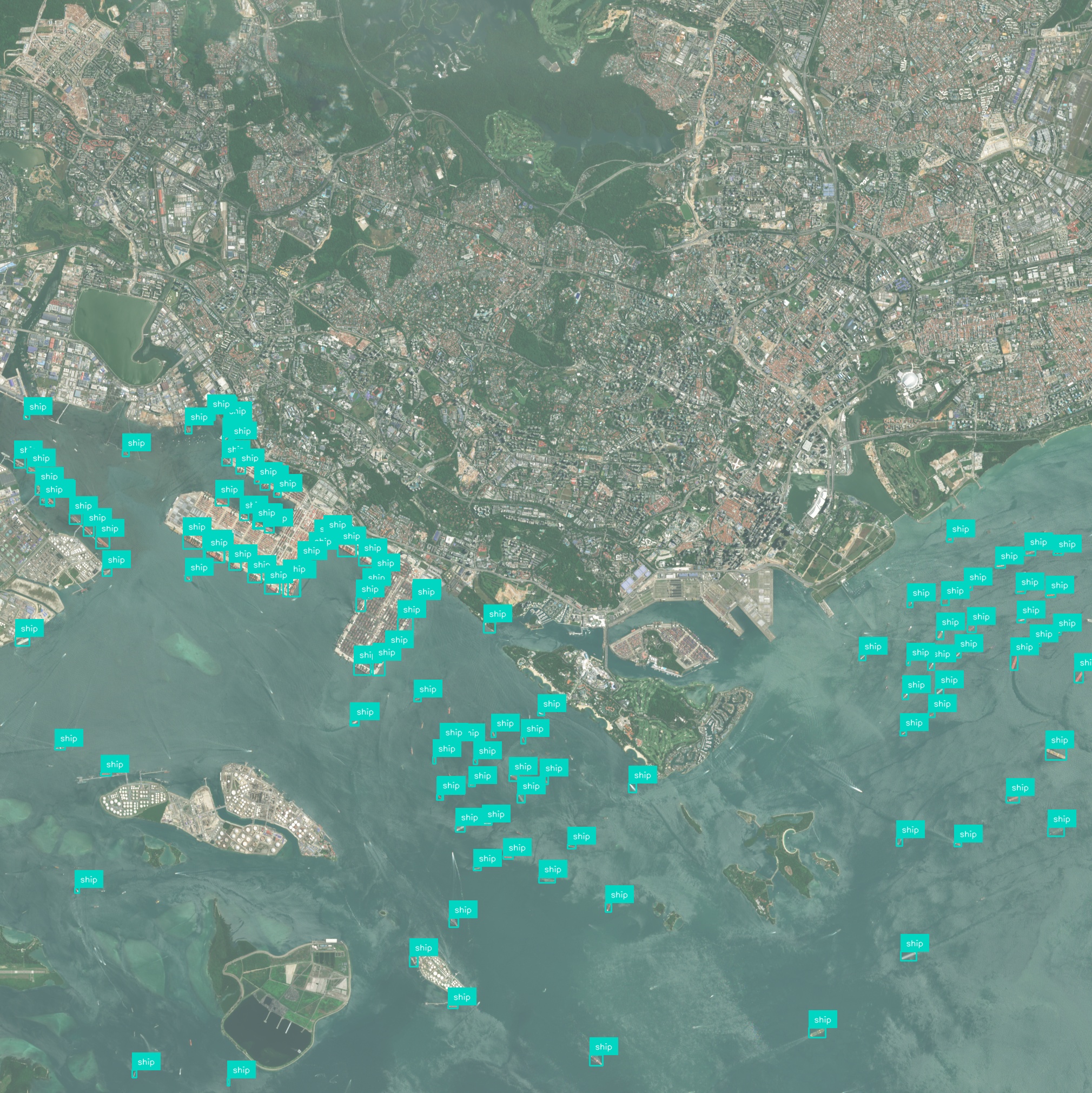

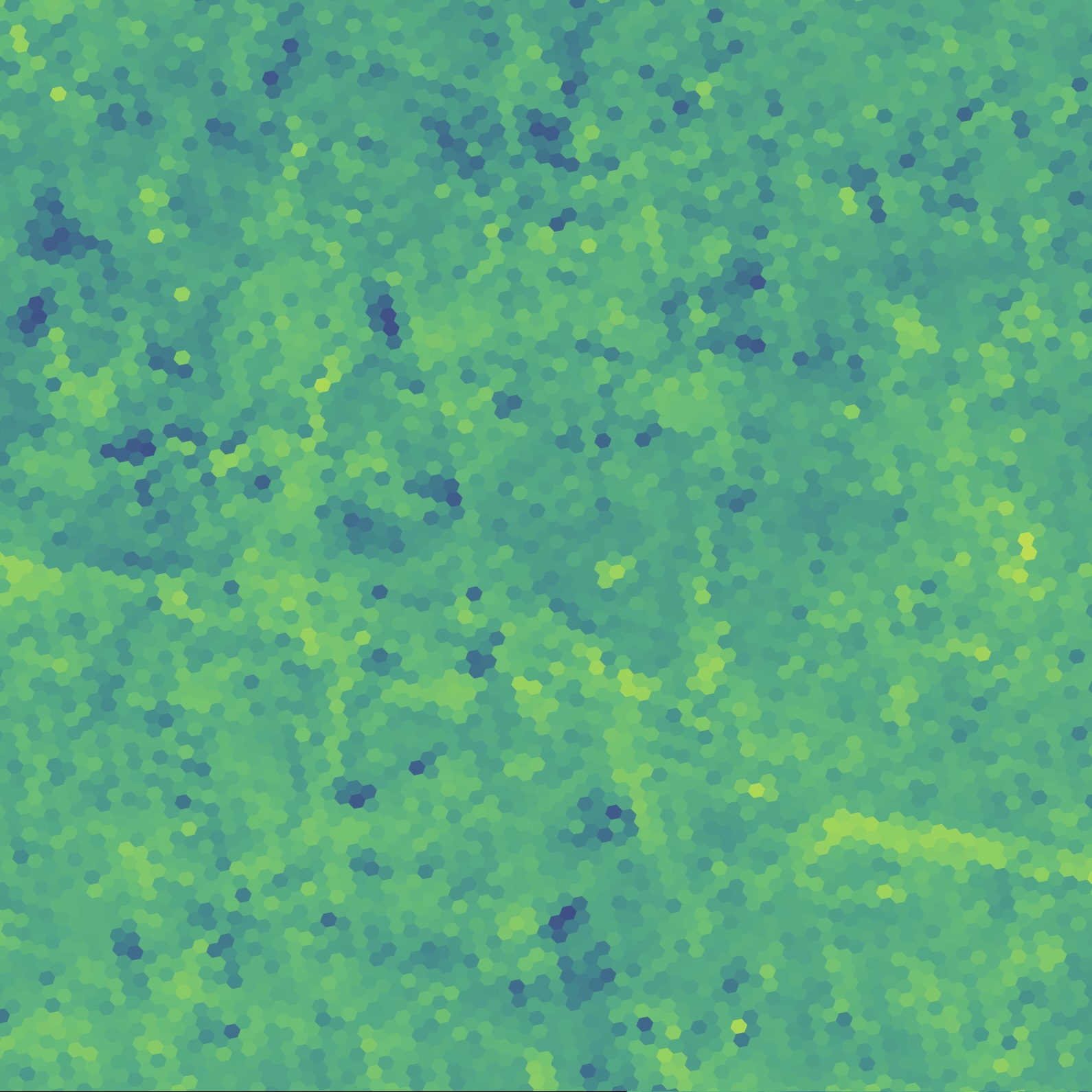

High-resolution spatial analytics map risk exposures across urban landscapes, highlighting clusters of high-risk assets. This supports portfolio diversification and targeted risk mitigation strategies.

The platform connects with existing underwriting systems via APIs for real-time data exchange. This integration streamlines processes and avoids redundancy in data management.

Have a different question and can’t find the answer you’re looking for? Reach out to our support team by sending us an email and we’ll get back to you as soon as we can.

Geospatial AI Platform

AI & foundation models

Deep-learning and foundation models turn raw imagery into ready-to-use insights, so you ship answers instead of training pipelines.

Conversational workflow

Ask questions in plain language and the platform responds with charts, visualizations, and next step suggestions.

GPU-accelerated cloud

Cloud-native architecture spins up on-demand GPU clusters that scale from a single scene to global archives—no manual ops, no bottlenecks.

Any sensor, any format

Optical, SAR, drone, IoT, vector or raster—ingest, fuse, and analyze without conversion headaches.

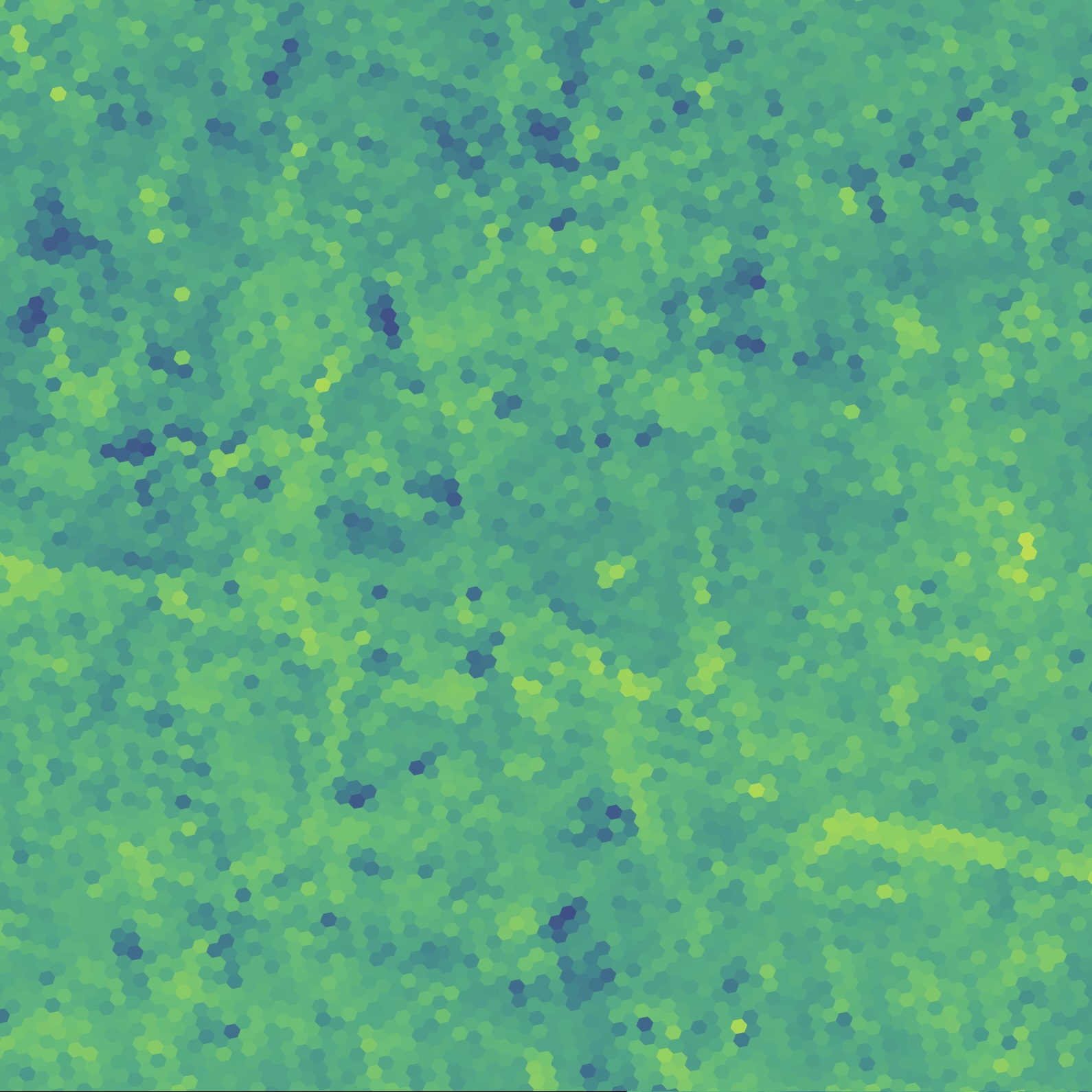

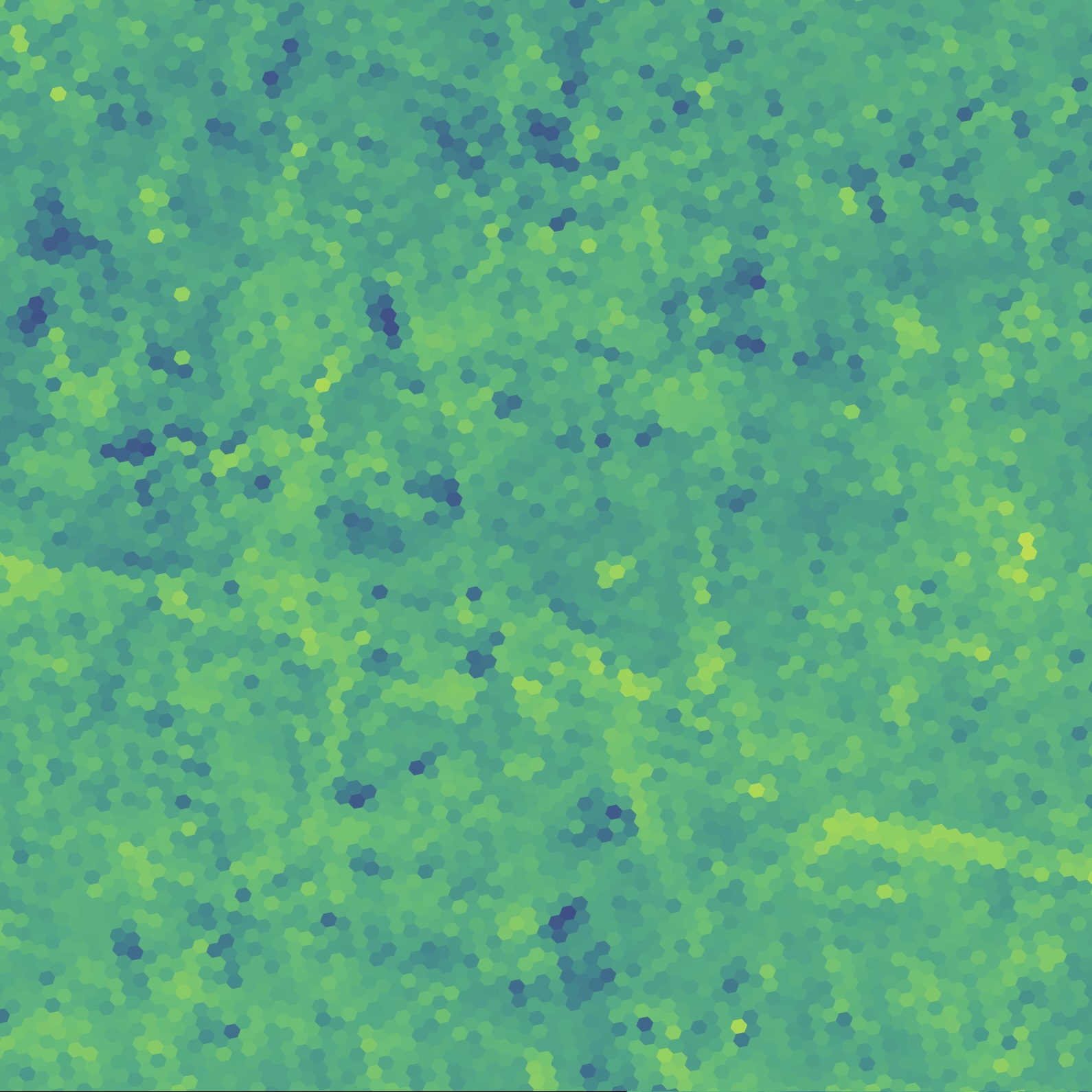

Insight you can see

Real-time 2D / 3D maps and export-ready plots make results clear for engineers, execs, and clients alike.

Turn satellite, drone, and sensor data into clear, real-time insights using powerful AI – no complex setup, just answers you can see and act on.