EconSat Insights

Real-time satellite-derived economic indicators reveal market trends from industrial activity, shipping volume, and retail parking density for data-driven investment decisions.

Real-time satellite-derived economic indicators reveal market trends from industrial activity, shipping volume, and retail parking density for data-driven investment decisions.

How does it work?

Traditional economic reports are often delayed and subject to revisions, leaving traders with outdated information when making investment decisions. Satellite-derived indicators provide near-real-time, unbiased measures of industrial output, transportation flows, and consumer behavior, enhancing forecasting accuracy and risk management.

Satellite data delivers economic metrics in near real time, reducing reliance on delayed official statistics. Early visibility into activity shifts supports alpha generation and improved timing for trades.

Imaging satellites monitor remote and emerging markets where ground data is sparse or unreliable. Consistent data across regions enables comparable analysis for global portfolio diversification strategies.

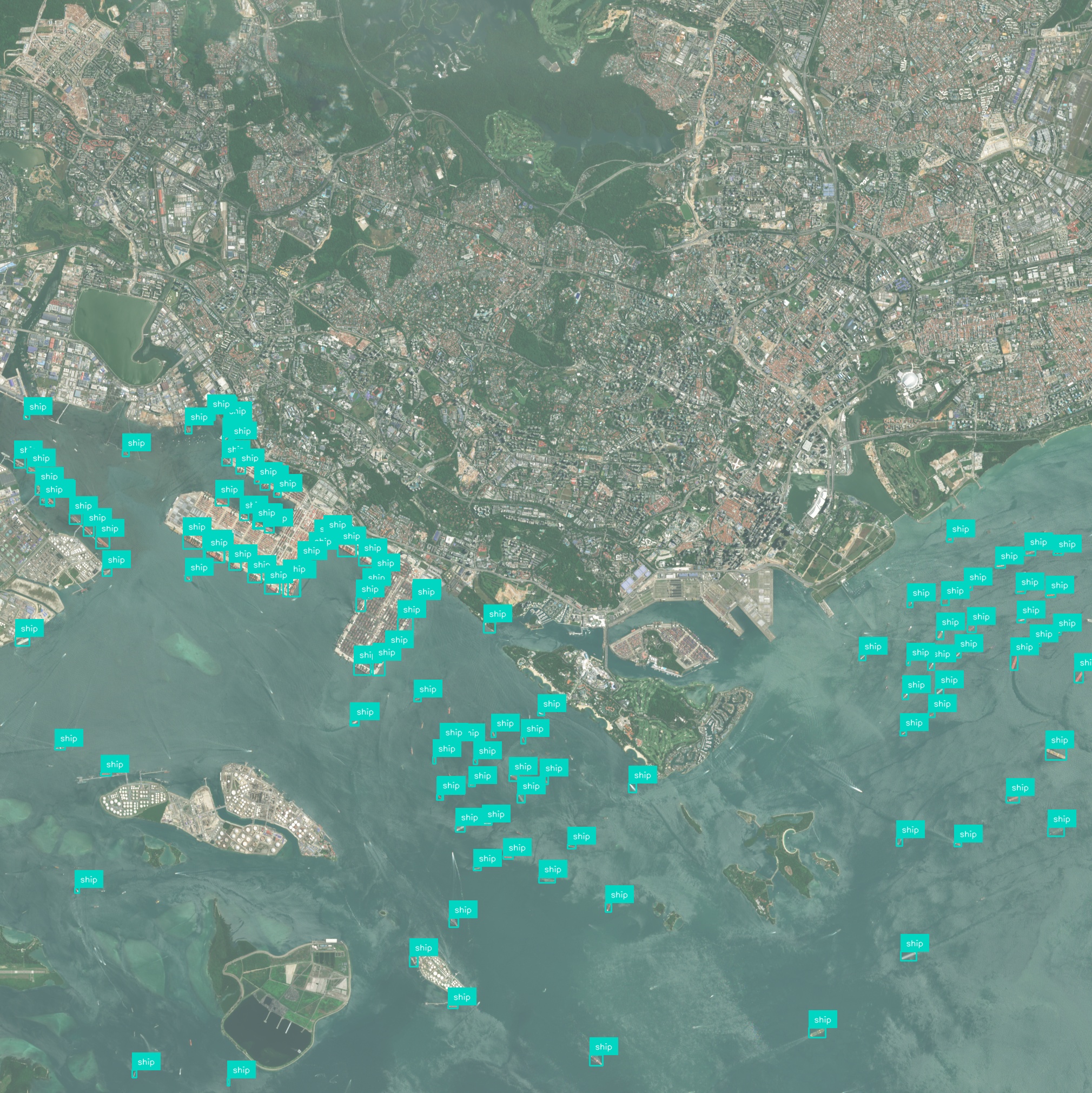

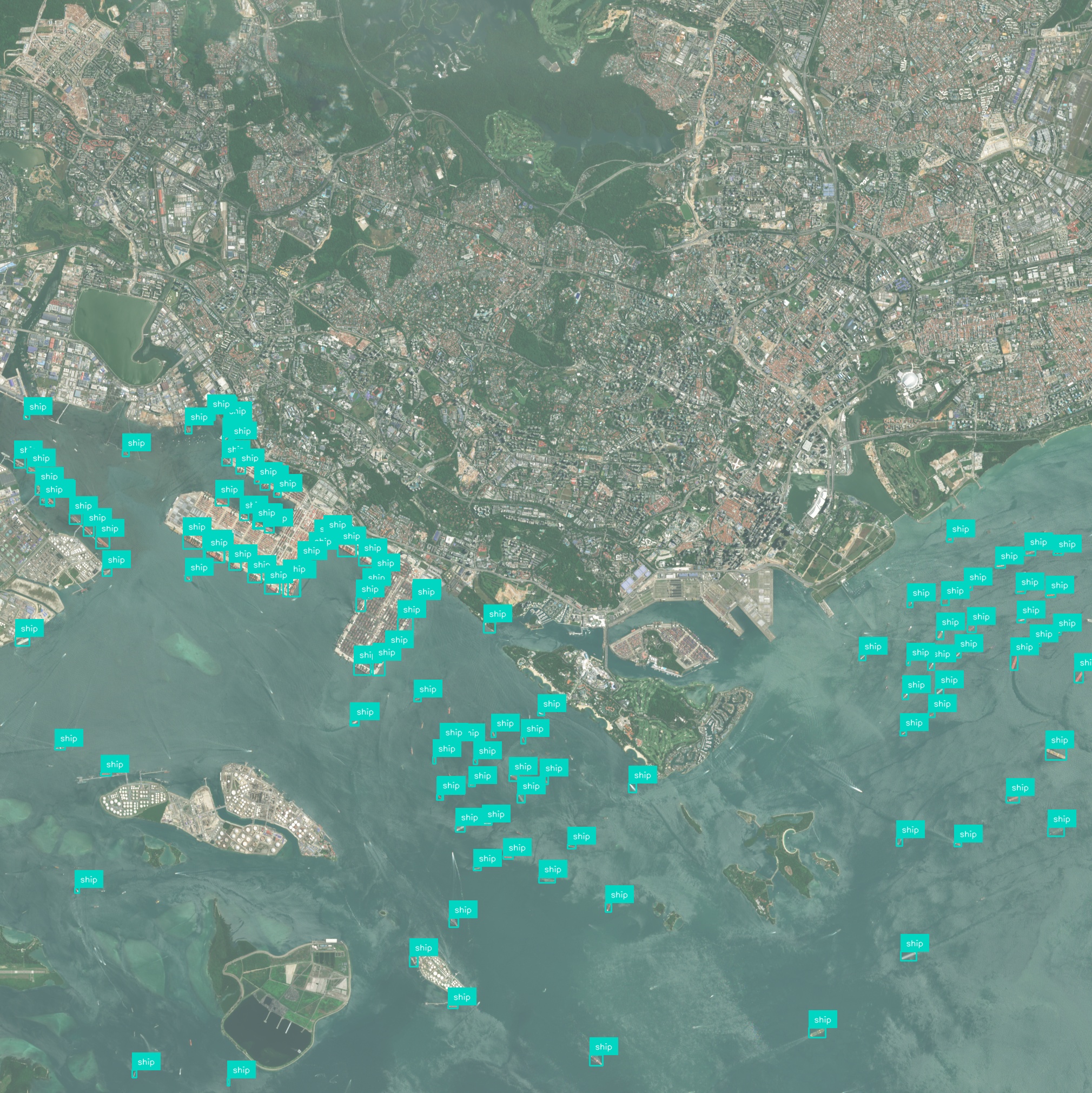

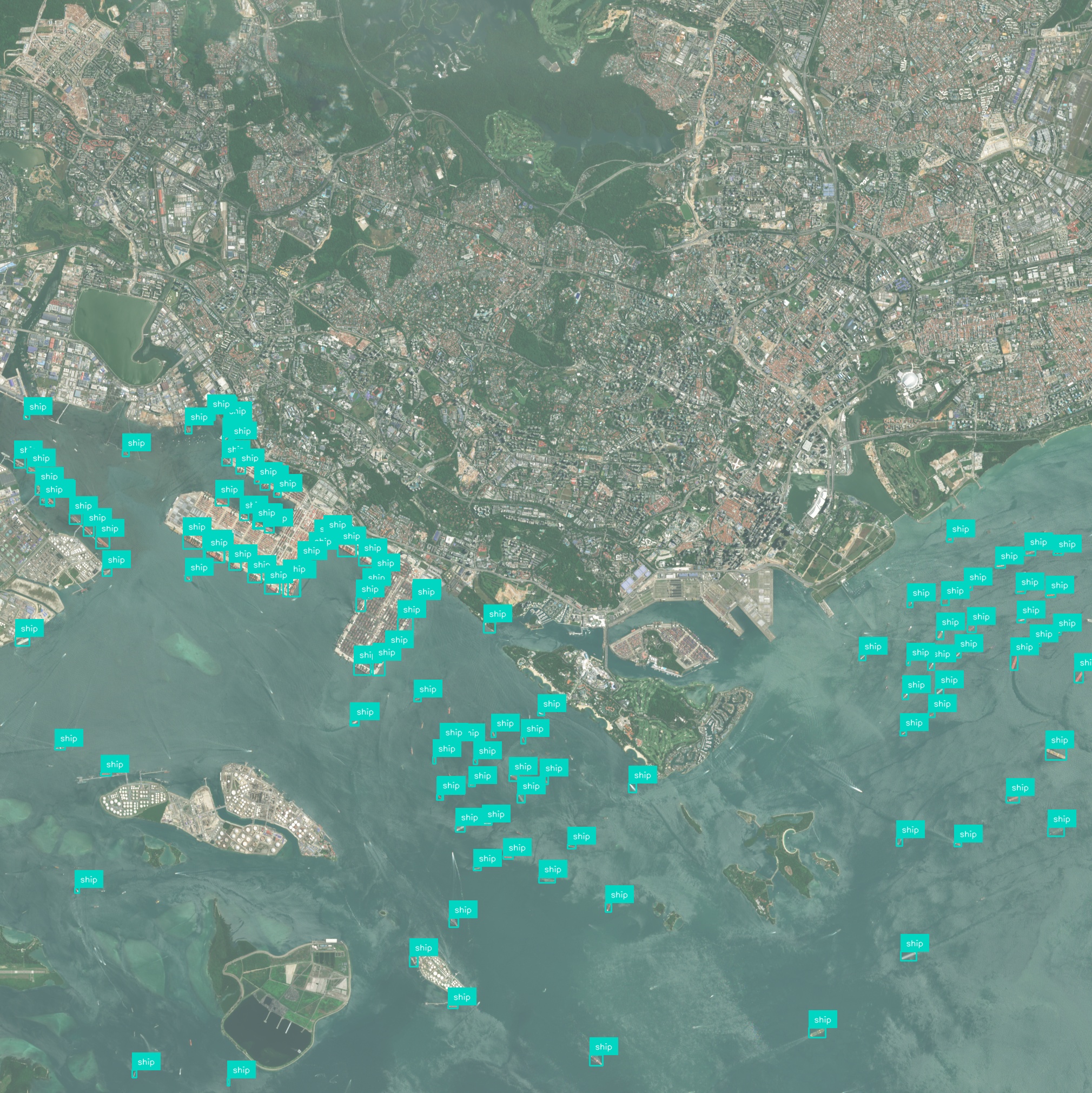

Tracking port congestion and freight movement flags bottlenecks affecting commodity and manufacturing sectors. This visibility helps investors anticipate price movements linked to logistical constraints.

Monitoring retail parking lot occupancy and nighttime lights proxies captures spending trends before earnings reports. Analysts can adjust revenue forecasts and sector allocations ahead of consensus.

Timely imagery identifies natural disasters, geopolitical events, or infrastructure disruptions that impact asset values. Proactive alerts facilitate dynamic hedging and contingency planning.

APIs deliver satellite indicators directly into trading platforms and analytics workflows. Custom dashboards and backtesting support automated strategies and streamlined decision-making.

Have a different question and can’t find the answer you’re looking for? Reach out to our support team by sending us an email and we’ll get back to you as soon as we can.

Geospatial AI Platform

AI & foundation models

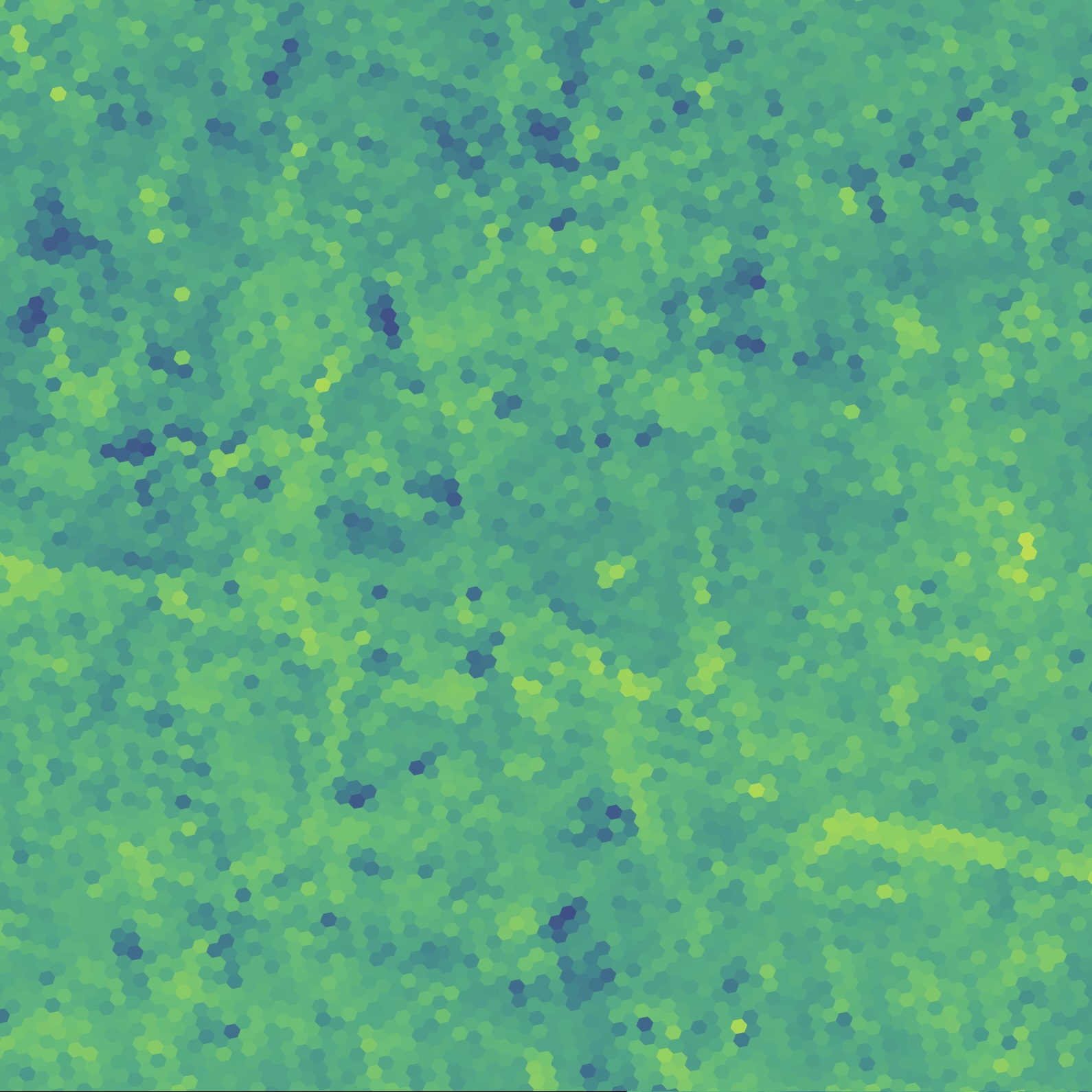

Deep-learning and foundation models turn raw imagery into ready-to-use insights, so you ship answers instead of training pipelines.

Conversational workflow

Ask questions in plain language and the platform responds with charts, visualizations, and next step suggestions.

GPU-accelerated cloud

Cloud-native architecture spins up on-demand GPU clusters that scale from a single scene to global archives—no manual ops, no bottlenecks.

Any sensor, any format

Optical, SAR, drone, IoT, vector or raster—ingest, fuse, and analyze without conversion headaches.

Insight you can see

Real-time 2D / 3D maps and export-ready plots make results clear for engineers, execs, and clients alike.

Turn satellite, drone, and sensor data into clear, real-time insights using powerful AI – no complex setup, just answers you can see and act on.